Hello

I am planning to move to Colombia and maybe later buy a flat/house/land there.

I know that the Colombian economy is doing good and the prices of real estate have been going up a lot in the last 5 or 10 years or something and that Colombia has been regarded as a business opportunity for many.

Myself i am not interested in making business but i am afraid to buy my house between now and 2020 at a high price and that later the prices will come crashing down because of a market bubble.

so i am asking the question, is it a good time to buy real estate in Colombia?

thank you

Real estate market in Colombia

I don't think that the Colombian economy is going great. The government has been lowering interest rates on mortgage rates to try and stimulate the enconomy. Also the banks have been lowering interest rates on CDT's.

I have observed several newer apartments and homes on the market that have not yet sold after six months. I would recommend renting something for now. If the peso starts declining then it may be a good opportunity at a later date.

thanks for the heads up

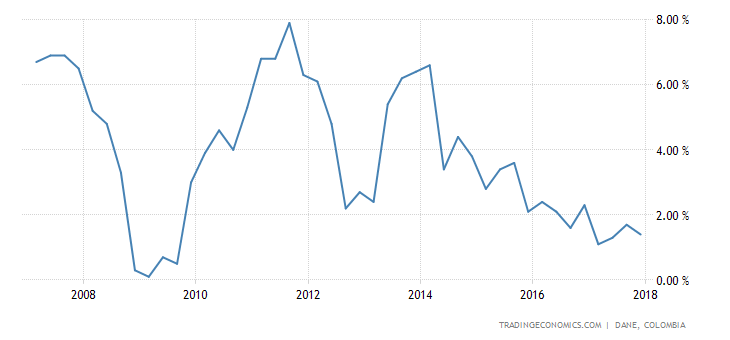

i was referring to the 4%, 6% and sometimes 8% GDP Annual Growth Rate in the last 10 years that might have influenced the prices of real estate to go up ( i am really not an expert at all, just trying to grasp basic trends, i think these rates meant the economy was booming but know it s slowing down it seems).

https://tradingeconomics.com/colombia/gdp-growth-annual

do you think the price of houses have gone significantly up in the last ten years?

i am starting to think it was a good idea to buy 5 or 10 years ago, but now it s getting risky or stupid. as you said, some houses are not being sold after six months which is really bad i guess and the prices of houses might go down significantly in the coming years then if this is a trend.

the market should not be the main reason to buy a house in a country or another, but rather where you want to live and enjoy your life... but still, that would stupid to lose your money because of the market. sad :-(

Hi unleashed,

Speaking as someone who just bought here, I think there are a lot of variables to consider. The currency you are using for one. The dollar is strong right now so I made the decision to buy based on capital preservation. I love living here so I feel that I cannot lose. I don't think that there is as much of a property bubble here as in other parts of the world due to strict banking rules and money laundering regulations. Having said that, most of the middle to upper class Colombians I've met, buy property with their savings as an investment, much as Americans did in the 60's, as a means to hedge against inflation or currency depreciation. Also the Colombian economy seems to be closely tied to the price of oil. Gasoline prices here seem to stay the same no matter what a barrel of oil costs, so unlike in the US, low oil prices do not add any stimulus to the economy and fewer state funds put a burden on the government, inhibiting state investment. I am in Medellin. Landstryker

@LandStryker thanks for the feedback

"I don't think that there is as much of a property bubble here as in other parts of the world"

> ok reassuring feedback... will get more feedback from more people before making my mind.

"I love living here so I feel that I cannot lose"

> i am going to Colombia in three weeks for a vacation and will soon find out myself if this country can be my new home :-)

Landstryker wrote:The currency you are using for one. The dollar is strong right now so I made the decision to buy based on capital preservation.

Interesting point. Made me look it up!

The Colombia Peso (COP) has lost about 43% of its value relative to the USD over the past five years. Stated differently, 1 USD bought 1,791 COP five years ago. Now, 1 USD buys 3,050 COP. (Got as high as 3,383 in early 2016!) Not bad if you're bringing in USD and, I would assume to a lesser extent, Canadian Dollars.

The negative (outweighed by the foreign currency exchange) is that Colombia has wild inflation at times - seems to have run between 2% and 9% over the past five years, maybe averaging an annual 4.5% inflation rate, more or less.

Hi SawMan,

I am no economist but I think averaging 4-5% inflation in a developing country would indicate growth more than a serious problem as long as it doesn't spiral up into double digits. Wages don't seem rise here as quickly so eventually demand should drop and inflation self correct. My guess is that there is a bit of a dual system here where luxury goods take up a large portion of that inflation rate. Haven't been here long enough to know for sure though. Landstryker

No property bubble or even close in most parts of Colombia right now. The issue with properties not selling quickly has got a great deal to do with sellers looking to sell themselves, instead of through professional and experienced agencies, plus pricing properties at random, ridiculous and silly numbers. It has nothing to do, again for the most part, with supply demand factors. Also, certain Colombia markets, Medellín, Bogotá and to a lesser extent Cartagena, have a very concentrated "desirable geographic zone" that is driving up prices to goofy levels, in some submarkets. Perfectly great areas go undersold and these micro areas see too much demand, not enough supply. But, again, it is micro submarkets, not the broader market. This trend is especially true where a heavy influx of expat funds have accumulated, since they tend to have a very myopic view of where is a desirable location to live. All depends on what you are looking for and how flexible you are, but if you are purchasing with foreign currency, exchanged for Colombian Pesos, odds are good you can get yourself a good deal today, if you know where and how to shop.

I do not know if the Colombian real estate market qualifies as a "bubble", however, looking at the real estate market of Cartagena, i can definitely tell you that a correction will come at some point

The numbers just don't add up. Prices are ridiculous and disconnected by a mile from the real economy. As a comparison, Cartagena prices are higher than Nice in France, or Miami, and what you get i basically a shack with third world public infrastructure and services

Average income income in Cartagena is $400 per month..

Plus, the economy doesn't look good for the coming years beside tourism and there is a great deal of political uncertainty remaining with the FARC deal. The taxes are aslo extremely high; one of the highest reates in the world and the government is broke and looking for money

I would definitely stay away from Colombia's real estate unless i find a smoking deal way below replacement costs in an exceptional location

cedricgopnik wrote:I do not know if the Colombian real estate market qualifies as a "bubble", however, looking at the real estate market of Cartagena, i can definitely tell you that a correction will come at some point.

Dear Cedric,

Welcome to the Colombia forums of expat.com ....

Yes, there is no one real-estate market in Colombia.

There are hundreds -- and hundreds (or more) sub-markets within geographically distinct markets.

Based on your Cartagena analysis, while prices there are above "true market" value, there are deals for brand-new homes in Coffee Zone cities in the range of $20,000 to $30,000 US.

cccmedia in Depto. de Nariño

cedricgopnik wrote:there is a great deal of political uncertainty remaining with the FARC deal. The taxes are also extremely high; one of the highest rates in the world and the government is broke and looking for money.

I would definitely stay away from Colombia's real estate unless I find a smoking deal way below replacement costs in an exceptional location.

Good for you, Cedric,  for throwing a barrel of cold water at newly-arriving Expats who show up here with rose-colored glasses.

for throwing a barrel of cold water at newly-arriving Expats who show up here with rose-colored glasses.

Besides the FARC deal, there are other troublesome groups such as ELN to deal with in the "era of peace" transition that Colombia has initiated. Violent acts including the assassinations of community leaders have occurred this year (2017), according to detailed reporting by colombiareports.com .... Intercity driving is unsafe in many areas at night, as those of us who have survived moto night-rider attacks can attest.

At present, the dollar is strong vs. the peso and has been .. but the currency rate could turn around and bite a new home-owner in a couple of years, decimating his home's value in dollar-terms when and if the peso rebounds.

New arrivals who follow certain guidelines can avoid the more violent aspects of life in Colombia. But, buy a home here as a new Expat?

Only if you're a gambler. Or you find that "smoking deal" in an exceptional location.

In any case, rent -- don't buy or build -- in your first full year in La República.

-- cccmedia in Depto. de Nariño near the Ecuador border

Cartagena has many real estate submarkets. The old historic district center is overvalued, because of simple supply and demand factors, combined with the difficulty of accommodating that demand with new construction in a historic area. A typical challenge for desirable historic districts globally. Certain very desirable oceanfront properties are also overvalued. However, I would argue that it is inaccurate to slam the entire Cartagena market as overvalued. More so, I certainly do not see Cartagena bearing the same prices as Miami or Nice, not for comparable product. You may pay the same, but your money will buy more in Cartagena. As Warren Buffett quipped in discerning price v. value, "Price is what you pay, value is what you get."

HGQ2112 wrote:You may pay the same, but your money will buy more in Cartagena. As Warren Buffett quipped in discerning price v. value, "Price is what you pay, value is what you get."

"It's not what you pay, it's what you receive."

-- Author/lecturer/presentation expert Robert Panté

***

Reason : Free advertising is not allowed.

We invite you to read the forum code of conduct

This website is not supposed to be used by people selling products.

And when Petro wins and everyone is leaving the country like Venezuela you'll never be able to sell anything cause no one will buy jack. I would wait till after the elections and see how things are working out in the country, unless you have lots of money to gamble.

I agree with HutchX2020 and this is what I have been trying to tell people on this thread. Don't do any real estate transaction until after it has been established that Petro has lost. We sold our apartment in Pereira this past year after owning for fifteen years because of the possibility the Communists may take over. Most of the wealthy Colombians already have their property waiting for them in Miami in case Petro wins. The people pumping property on this thread may also be planning ahead for a different political situation in Colombia.

You did the right thing Laker4115 by thinking ahead.... it amazes me how people make life decisions without taking into account the political situation in a certain country, also rents are very affordable in Colombia why risk such huge losses but that's my personal opinion.

Looking at this without a dog in the race, there's no way I'd even think about buying at the moment, especially if I was American.

The political situation, even after ignoring sensationalist stories, appears duff at best.

If an ultra left candidate does win, or forms a coalition, there might well be sanctions and all the usual stuff that will make a mess of expat plans.

Without all the political baggage (I dumped mine), history shows us extremist governments of any flavour tend to mess up their country, but ultra left ones get a lot of help from other countries to do it.

"Chavismo" ring any bells?

The fact is that the Colombian housing market is not subject to the wild fluctuations that typifies the USA market.

Over the years prices have risen in line with the inflation and not been affected by changes of government or international financial crises.

That's because we ha e not had comunists take over till me how is the housing market in Venezuela?

It is pretty stable and is not affected by Venezuela thanks.

fordtruck2003 wrote:It is pretty stable and is not affected by Venezuela thanks.

One country's ecconomy may not actually effect that of another, but it can give us indications as to what may happen if a given set of events come to pass

Auxico is worth a pretty massive mention as their find is a game changer. If an ultra left government gets into power and nationalise the lot, expect massive problems.

Oil and RREs are most likely to be in contention, but gold and other minerals might well play a part.

One country will sanction and generally do whatever it can to mess up the government, and another will invest like mad- but at terms they dictate because they know Colombia will be desperate.

Politics are rarely about people, more about cash in some bent twit's pocket.

Colombia, especialle Medellin is indeed a great spot for real estate. [link moderated]. Every year the buildings get higher in Medellin.

The Colombia gamble.

If you must gamble on an investment in Colombia real estate aside from your personal residence, do so in the larger cities, not in rural backwaters where FARC, ELN and the paramilitaries may have sway.

The government has done a good job in protecting the cities in the post-Escobar area, leaving less populated places vulnerable, especially after dark.

Do not buy rental properties in Colombia, no matter how many 'oportunidades' International Living and Live & Invest Overseas may present, unless you have been successful with these in Colombia before.

cccmedia

For anyone impressed with tall buildings you should go to Caracas which has plenty of tall buildings which were built before the Communists took over. The only thing about them is that you might find it hard to get to the twentieth floor with no electricity for the elevators. Colombia may will be in the same situation in three or four months if Petro wins.

Petro may win, but his party doesn't have majority in Congress. His proposals will be very difficult to pass, and the presidential's executive authority is greatly limited (i.e. can only authorize certain things without congress' approval for 30-60 days). President's office is limited to 4 years as well.

But, foreign investment will be much lower if Petro wins. His ideas on stopping drilling and mining will lead to very high inflation, if it gets passed. The wealthy can absorb the costs. The middle class will have to reduce their spending, and the poor get screwed...the people he claims to support.

Any president who wins is going to have a rough time now as none of them have majority in congress.

In Venezuela Maduro also had the Congress against him, he just rewrote the Constitution in essence deposing the old Congress with a new one of his choosing giving him all the power. If Petro needs to change the Congress to run the country he will do so just like Maduro.

OMG.

Here's another reason why I will never buy

real estate in Colombia, even though I love

the country and visit often from Ecuador.

According to www.colombiareports.com,

a think tank study by Indepaz has

determined that guerrilla violence and

armed conflict have started to move from

the traditionally rural areas where the

malditos have operated since after the

Escobar era ended .. into more

urban areas, especially municipalities

in the North.

The article is dated December 21, 2022.

Based on this article about the study,

this does not appear to be an

immediate threat to the most

Expat-friendly urban areas

of Colombia such as Medellin

and the Coffee Zone capitals.

cccmedia in Quito, Ecuador

OMG.

Here's another reason why I will never buy

real estate in Colombia, even though I love

the country and visit often from Ecuador.

According to www.colombiareports.com,

a think tank study by Indepaz has

determined that guerrilla violence and

armed conflict have started to move from

the traditionally rural areas where the

malditos have operated since after the

Escobar era ended .. into more

urban areas, especially municipalities

in the North.

The article is dated December 21, 2022.

Based on this article about the study,

this does not appear to be an

immediate threat to the most

Expat-friendly urban areas

of Colombia such as Medellin

and the Coffee Zone capitals.

cccmedia in Quito, Ecuador

-@cccmedia

My neighbor recently began warning me that the gangs have moved into our community of 2500 people...a small village in the Coffee Zone. He's also stated people have mentioned/gossiped that I am 'rich'....somehow, even though I work in the fields just like my neighbors, and I need to make sure I have protection.

From the report you cite:

"The AGC is by far the largest or these groups formed by dissident former AUC members. The far-right former president [Duque] made no visible effort to reduce the territorial control of the AGC and other paramilitary groups... Duque's successor, President Gustavo Petro, has embarked on a policy that seeks to negotiate the demobilization and disarmament of the illegal armed groups in order to allow an expansion of state control over his country's national territory and population."

Conclusion: The main problem in Colombia is right-wing paramilitary violence, not left-wing guerrilla violence. AUC was a creation of President Uribe. President Duque did nothing to stop the growth of right-wing violence. President Petro is trying to negotiate with ALL the groups on the right and on the left.

Of course, you need to take into account the political and economic situation when deciding to buy real estate in a particular country. I myself hesitated for a long time, weighing the pros and cons of investing in real estate. In the end, I decided on the UAE. It is a rapidly developing country with great potential. In addition, purchasing real estate here has greatly simplified the process of obtaining residence rights. On the Properties for sale in Dubai Marina website ( https://everhomes.ae/buy/properties-for-sale/c/dubai-marina/ ) , you can see the available offers. This made the search very easy for me.

@futuroexpat

Are you going to cry when your woke socialist hero with a 25%.approval rating gets punted in 2 years without fulfilling his far left agenda or any of his "promises"?

Are you going to cry when your woke socialist hero with a 25%.approval rating gets punted in 2 years without fulfilling his far left agenda or any of his "promises"? -@nico peligro

There is evidently a misconception among some of our members --

and Nico is not alone in this -- who think that Presidente Petro

can run for re-election.

According to Article 125, ratified in 2018, no person who is

elected to a presidential term can be elected to a second.

Petro will not be the first Colombian leader to be

term-limited from attempting a re-election run.

Ivan Duque was prevented from running for a second term

in 2022 in the year Petro was elected.

See Wikipedia page titled Presidency of Colombia.

cccmedia in Santander

@andrewnaum20 I doubt there any useful properties in the UAE that are in the sub-$100K price range...

Investing in real estate in AED?? Is this a joke. Is this for investment purposes only or a purchase to live there, urrrrrrr

The extreme heat, brutal humidity, predominant religion with it's repressive culture, located completely in a desert............hell no, no thank you.

I looked at the noted website listing property for sale, prices for a 2 bedroom condo, nothing special roughly $700,000. USD, urrrrrrr you can have it and I will stick to my life in a small pueblo located an hour outside of Medellin.

@cccmedia Of course I knew this

My point.was exactly that..even though if he was allowed to run again he would lose..and the fact he wasnt able to implement any of his far left ideas..none that will be permanent after he is gone anyway

@nico peligro I agree one hundred percent. Worldwide there seems to have been a swing to liberal policies and from my viewpoint they have generally been a flop. I predict that the pendulum will swing back somewhat hard for the more conservative arena. In some cases that is a good thing and in others not so good. Time will tell...

lpd