The 2 papers I have are :

1. EU ID Card

2. A lease contract in Malta

I already applied for a SSN online but they are asking for an employment contract ( which I don't have ). Most of my income comes from rents out-of-Malta, and I am not happy with letting them know what I own.

Employment for a few months could be an option, before deciding if I like the bureaucracy/lack of .

I'd like to solve most of the paperwork in a few days when I'm in Malta.

Can fly later to finish paperwork.

What would be your suggestions in this case ?

EU ID card + lease contract - where to apply ?

" Most of my income comes from rents out-of-Malta, and I am not happy with letting them know what I own."

Unfortunately you are required by law to declare your world wide income once resident in Malta.

Terry

tearnet wrote:" Most of my income comes from rents out-of-Malta, and I am not happy with letting them know what I own."

Unfortunately you are required by law to declare your world wide income once resident in Malta.

Terry

You only need to account for monies remitted to Malta or earned in Malta in your Maltese tax return!

If you pay tax in the UK on your income you can offset that against tax due here!

Ray

What other papers can I ask in the mean time ?

There is SSN....and what else ?

( Foxglove, thank you for the info. I'm Canadian. Of course I pay tax. )

F0xgl0ve wrote:tearnet wrote:" Most of my income comes from rents out-of-Malta, and I am not happy with letting them know what I own."

Unfortunately you are required by law to declare your world wide income once resident in Malta.

Terry

You only need to account for monies remitted to Malta or earned in Malta in your Maltese tax return!

If you pay tax in the UK on your income you can offset that against tax due here!

Ray

Not true, you have to declare ALL your income ( worldwide) on your tax return. This does not mean that you will pay tax on it as some countries have dual taxation agreements but it does have to be declared.

From the tax office...

" Employment income is to be declared even though tax would have been deducted by the employer. The gross amount and tax deducted must match the FS3 details provided by the employer.

Business income and expenditure must be recorded on the provided profit and loss account. The net profit is to be declared in the tax return.

Pensions are to be declared and added to any other earned income in arriving at the tax due for the year.

Income earned outside Malta must be declared and the taxpayer has the option to deduct tax at a flat rate of 15%.

Local interest is to be declared in the case that no withholding tax has been applied."

Terry

Never seen that on the tax return and it is not the information I have been given by the tax office!

Obviously the incomes mentioned in your first three paragraphs apply because they are referring to Malta derived income. The fourth, I assume, is for a Maltese national with income derived from abroad.

If in doubt, consult an accountant!

Ray

Agreed; if anybody has unusual tax issues, always speak to a professional.

non domicile status is what you should consider in addition to Terry said.

Money earned in the UK and stays in the UK surely cannot be taxed here. Obviously if any of that money is transferred here then it would be liable.

RayAucote wrote:Money earned in the UK and stays in the UK surely cannot be taxed here. Obviously if any of that money is transferred here then it would be liable.

We are not talking about paying tax on amounts earned outside of Malta but you do have to declare it.

Paying tax on your world wide income will depend on your personal circumstances and any reciprocal agreements with other countries.

Terry

In many countries, there are double-taxation agreements (DTA) in place with other countries that generally say that income-tax will not be charged twice. However, where people come unstuck, is that many resident countries have additional social taxes that all are liable to pay (regardless of citizenship); these are not regarded as income taxes, so not subject to the DTA and tax is liable. This is why countries require residents to declare there world-wide income.

Some examples:

US citizens regardless of abode are required to make a declaration to the IRS; also (potentially) to home state.

All living in Holland are subject to social taxes that fall outside the scope of any DTA.

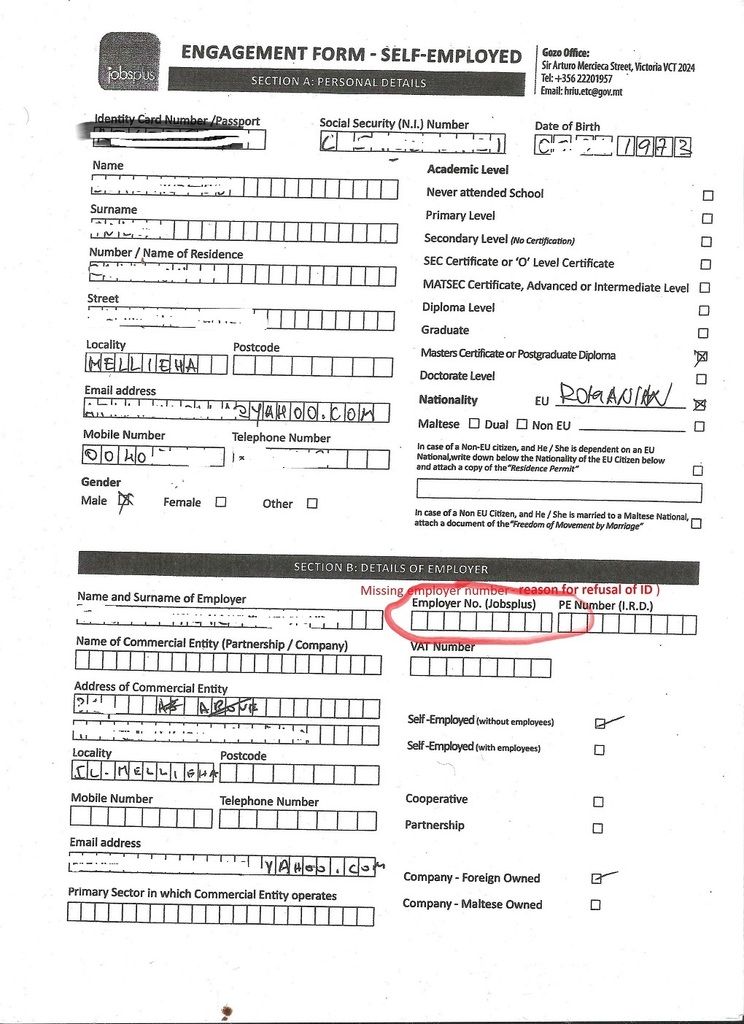

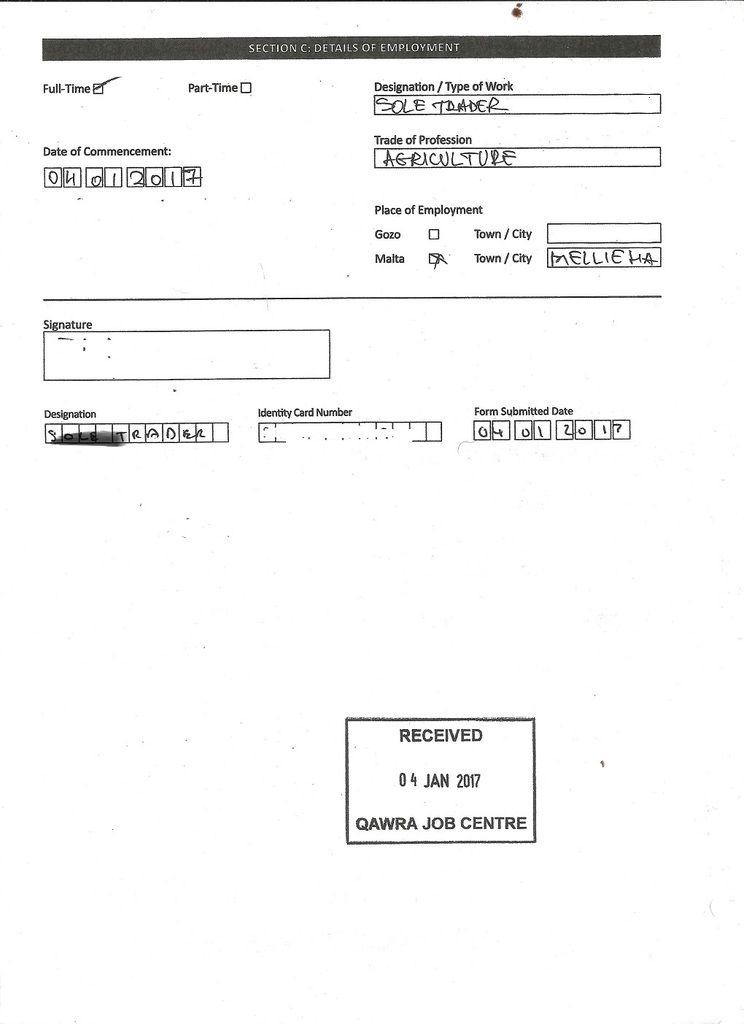

Obtained the SSN by simply going to Jobsplus and completing a form as self-employed.

They asked for the European SSN - I told them I have it, but not there and they however emitted the stamped form.

It seems ( Jan 2016 ) that the form was not enough to obtain Maltese eresidency , as it dit not have an Employer Number ( see picture 1 ) , although it was officially stamped ( see picture 2 ).

Made a complain to the EU and will keep the community posted on how it works ( thread here : https://www.expat.com/forum/viewtopic.php?id=641494 )

Will keep informed on the tax issues once I will have a tax number  )

)

I am doing some work for a Taiwanese company which pays me in the UK - I was thinking of just doing self-sufficient though because they won't have a job plus number.